Enterprises today have many data center outsourcing options to choose from, and service providers are ready to help, offering anything from simple data storage plans and other individual services all the way to a complete transition to a cloud infrastructure. The ISG Provider Lens™ Data Center Outsourcing Archetype Report explores the services for data center management and transformation available in the market today. The report also provides an overview and analysis of the stages a typical business experiences in terms of outsourcing, technology adoption and maturity, and how the stages translate into different requirements. It explores how service providers are adapting their portfolios and developing new competencies to appeal to different clients across this spectrum.

This ISG Provider Lens™ report summarizes months of research focused on data center outsourcing services, key service providers in this space and the buyers of these services. We identified four archetypes that represent typical, frequently encountered categories of enterprise user types: Traditional, Managed Services, Large-scale Transformation and Pioneers. Each archetype represents a distinctive set of business and technological needs and challenges data center services clients face. The report summarizes data center outsourcing service providers’ relative capabilities, and their abilities to address the requirements of each archetype.

Enterprises categorized in the Traditional archetype have their own data centers, and they value having greater control of their assets. They also believe in protecting their existing infrastructure investments. These enterprises do not pursue outsourcing for any significant disruption to their business model, and the applications involved mostly have predictable load and traffic. Organizations in the Traditional archetype mainly need help for backup, patching, updates, monitoring and routine support, and may prefer staff augmentation to work alongside their internal IT team. Traditional enterprises are not keen on hybrid cloud adoption and are mainly focused on cost optimization.

Key Findings

Traditional data center outsourcing services buyers are looking to:

- Optimize expenses and improve cost efficiency

- Protect their existing investments in enterprise data centers

- Contract via fixed-fee pricing

- “Keep the lights on”

- Lift and shift operations (from one data center to another)

To meet these requirements, data center outsourcing services providers must demonstrate capabilities that include the following:

- Competence in routine data center outsourcing work, such as server monitoring, storage management and database administration for the captive data center

- Offer staff augmentation and complete outsourcing for ongoing operations or for ad-hoc projects

- Minimal disruption to operations during the lift-and-shift process

- Virtualization projects on an incremental basis, as necessary (for example as capacity limits are reached in a data center)

- Some degree of predictability in the volume of work to be performed

And the Leaders Are…

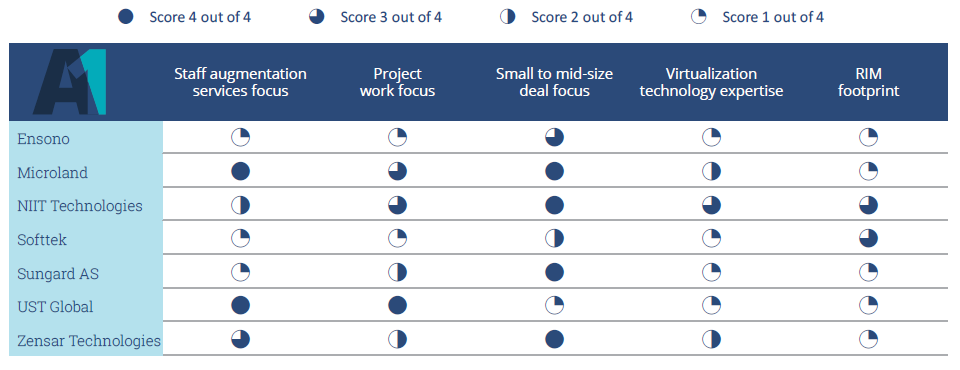

Of the 25 providers included in our research, seven stand out above the others for matching the Traditional archetype client requirements. These seven, referred to as Archetype Leaders, and their relevant capabilities are presented in Figure 1. Providers are not listed in rank order, nor does ISG claim that they are the only providers that could satisfy the requirements and demands of this buyer type.

Figure 1: Leading Service Providers for Traditional Buyer

Source: ISG Research, 2017.

As with all our ISG Provider Lens™ research programs, more than 40 providers were invited to participate. Not all responded. The providers that elected to participate in our research for this report were: Atos, Capgemini, Cognizant, Dimension Data, DXC Technology, Ensono, HCL Technologies, IBM, Logicalis, LTI, Microland, Mindtree, Mphasis, NIIT Technologies, NTT Communications, NTT DATA, Softtek, Sungard AS, T-Systems International, TCS, Tech Mahindra, Unisys, UST Global, Wipro and Zensar.

Some of the providers that are typically included in our research were not included in this report. Of these, some were not able to participate, and some declined to participate. Providers that serve only certain regions or industries or that do not offer a full portfolio of data center outsourcing services were not included in this study. They may be included in future versions of this report, based on merit and on their willingness to provide current and relevant materials. Readers should not make any inferences about a services provider’s absence from this report.

Using this Insight

The intent of ISG Provider Lens™ reports is to provide fact-based, qualified insights regarding services providers’ suitability for a defined sets of enterprise client service needs. These assessments are developed using data, analysis and comparative methodology as described in each report. No recommendation or endorsement is indicated, suggested or implied. Clients must make the decision to engage with a provider based not only on their specific, current data center outsourcing needs, but also other factors such as cost, culture and timing.

Customized versions of this report are also available from UST Global

Associated Insights and Links

ISG Provider Lens™ Data Center Outsourcing Archetype Report 2018

ISG Provider Lens™ Infrastructure & Data Center / Private Cloud Quadrant Report 2018: co-location - U.S.

About the author

Shashank Rajmane is a team leader in ISG Research.