We’ve seen more and more discussion about crypto-currencies – i.e., blockchain-based digital assets - among enterprise clients, IT providers, and pundits. A repeating discussion point is inevitably their fantastic volatility. Also frequent is commentary about what is driving those price changes – i.e. changes in the “fundamentals”.

The value of today’s cryptocurrencies is purely speculative. For cryptos, the only backing is the generally accepted value of cryptographic proof. While Bitcoin’s proof of work protocol addresses this problem to some extent, almost every other crypto solves it slightly less well – or at least differently – across a spectrum of “as good as bitcoin” to “completely untested,” there is no “standard” to meet, though.

The inherent price volatility also makes cryptos a bad store of value; and the medium of exchange issue is also somewhat problematic, first because the opportunity cost of not holding bitcoin is very high, and second because it is not accepted in exchange for very many goods or services. If your dollar today is worth $2 tomorrow, it makes you wait to make purchases. This lack of stability makes them inherently less valuable as currencies and drive the perception that they are really more of a speculative investment.

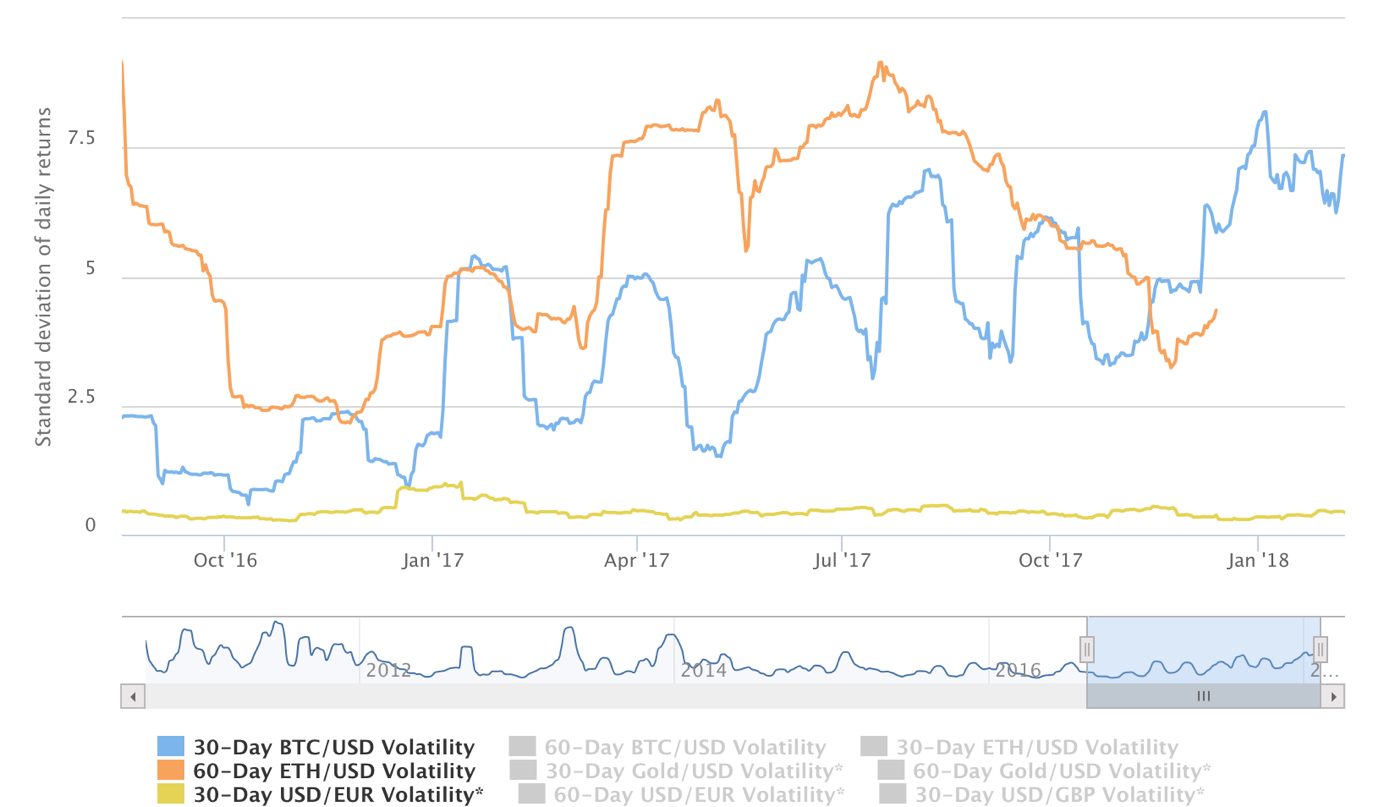

Bitcoin, Ethereum, and USD/EUR Price Volatility

Source: https://www.buybitcoinworldwide.com/volatility-index/

Underneath it all, while there are many benefits to the crypto ledger system, the whole crypto concept as it exists today might simply not be human enough for the majority of potential participants in the economy. The lack of physical tokens (e.g. paper money or coin), regulation, financial products, exchange rates, and so on means that the concept is too esoteric for almost anyone except financiers and speculators. And, while financiers tend to love complexity, they also have the backstop of typically working within a system that uses the same means of exchange that the rest of us use for mundane, human stuff like buying groceries. This may not be disqualifying, but it limits crypto’s mass-market appeal a bit. Most people never spend as much time thinking about what a dollar represents in their whole life as much as many crypto-enthusiasts have the last 6 months – the intellectual barrier to entry is very high.

At some point – and the process is already underway – governments, regulators, and corporations will adopt elements of the underlying blockchain technology into their IT environments. Blockchain technology is already “real” enough to have the characteristics demanded by business as part of a back-office ledger. The Cryptocurrency hype may be the tip of the spear, but the underlying blockchain technology itself is the far more transformative paradigm. Blockchains will be useful because they will become part of the mundane, regulated and predictable business environment, rather than a means of creating and exchanging exotic and speculative assets.

Associated Insights

Leveraging Blockchain’s Market Phases

Briefing Notes – Luxoft’s Blockchain Accelerator Services

Alex conducts research and writes about emerging trends and markets for ISG Insights. He focuses specifically on integration, analytics, social business and super emerging technologies, including the Internet of Things, 3D printing, virtual and augmented reality and drones. Alex manages and analyzes survey data, conducts briefings and interviews, and publishes research documents as a part of the ISG Insights team.