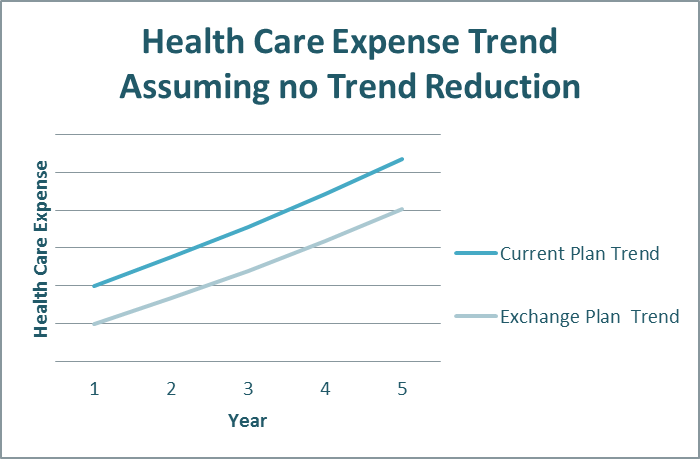

For Human Resources executives considering moving employees or retirees to a Health Care Exchange, the cost savings are relatively easy to estimate. With a bit of plan design and claims data, healthcare exchange providers can provide a high level prediction of the economic impact of moving from your current delivery model to the exchange. Estimates for short-term savings range from two percent to more than 10 percent depending on how efficient your current plan design is; a company spending $100 million might see an immediate cost reduction of $10 million. Over the long term, assuming that healthcare inflation will continue at a similar pace, the impact remains, as outlined in the following chart.

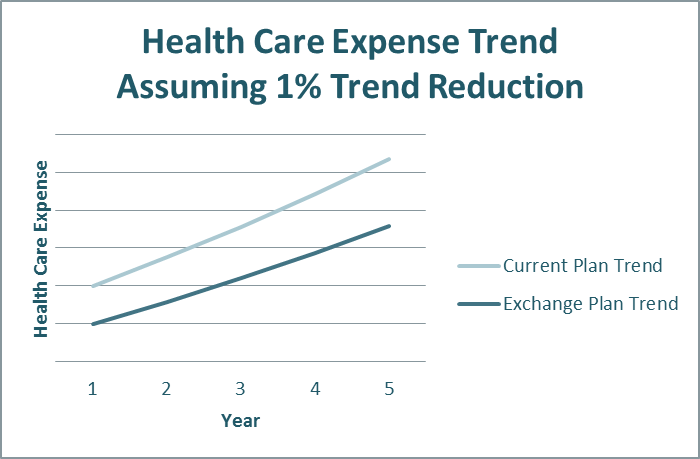

The promise of the exchange concept is that the cost savings impact over time could be even greater. Assuming a one percent differential in trend with an exchange, the saving increase becomes more pronounced, as shown below.

Here are the ISG Top 5 key elements to explore when considering the Health Care Exchange model.

1. Employer contribution strategy – An employer’s contribution strategy reflects overall benefits philosophy. Some are paternalistic, taking a traditional defined benefit approach to ensuring the employee has adequate coverage through carefully selected plan choices. Others are comfortable moving to a more consumer-driven or defined contribution model. Under a defined contribution approach, the employer provides a sum of money to the employee and access to a “marketplace” through the exchange to purchase their benefits, shifting risk and choice to the employee. Many see this as a first step towards an “exit strategy” from ongoing management of health and welfare programs.

2. Employer funding requirements – Some exchange providers require a premium (fully-insured)-based funding method, typically aligned with the defined contribution focused exchanges. Others offer both self- and fully-insured models. Some considerations for funding methodology include risk assumption, variability of cost over time and cash flow.

3. Provider/carrier networks – Do you want to give your employees lots of choices? Or narrow down the options for them? Evaluate what’s important to your company, either open access to many provider networks throughout the country or a narrow set of pre-selected networks.

4. Approach to and expectations of cost savings – Potential cost savings, both short- and long-term, are the major driving force behind private exchange development. Approaches to achieving these cost savings can include competition among carriers, reduced administration processes, plan management, pooled rating, improved wellness programs, stronger participant communications, visibility to healthcare cost, narrowing networks and cost shifting to employees.

5. Service Mix required – Three areas to review are: services and plans that must be included; standard services that are included; and those that are optional at a separate fee. Each exchange defines these differently. The mix can range from simply including medical, dental and vision coverage to a requirement to include life, disability and voluntary insurances. Some require the outsourcing of benefits eligibility administration to them. If you have strong preferences to include or exclude certain services, such as HSA or COBRA administration, understand which providers match your preferences.

Understanding the choices available and how they align with your benefits philosophy and objectives is the critical first step in implementing a successful healthcare exchange strategy for your company.

To learn more about navigating the exchange marketplace, contact us.