Yesterday, at our annual ISG Automation Summit in Manhattan, we had the opportunity to reveal the results of the new ISG Research “Bot 3.0” study, which measures the state of enterprise automation capability today – and collect some group intelligence to forecast where enterprise automation is headed tomorrow.

We believe this research represents a new way to both articulate and measure enterprise automation capability, so it was fantastic to get to show the 130+ enterprise leaders, media and providers in attendance the findings we’ve been uncovering the past couple of months. In fact, a number of automation leaders were quick to embrace our Bot 1.0, 2.0 and 3.0 terminology as a way to describe where they are in their automation journey.

The framework has 30 qualitative and quantitative factors. We developed it hand-in-hand with our advisory team, who are helping some of the biggest and best companies in the world build and scale their RPA operations, so it represents the most current thinking about what makes for a mature RPA program.

- Bot 0 companies have in place an RPA proof of concept or pilot.

- Bot 1.0 companies have RPA in production and have had in place a center of excellence (CoE) for at least six months.

- Bot 2.0 companies have had their CoE for at least a year and are experimenting with cognitive.

- Bot 3.0 companies represent the tip of the automation spear and have deployed RPA in multiple functions; they have at least one cognitive use case in production (connected with RPA to extend the scope or scale of processes that can be automated).

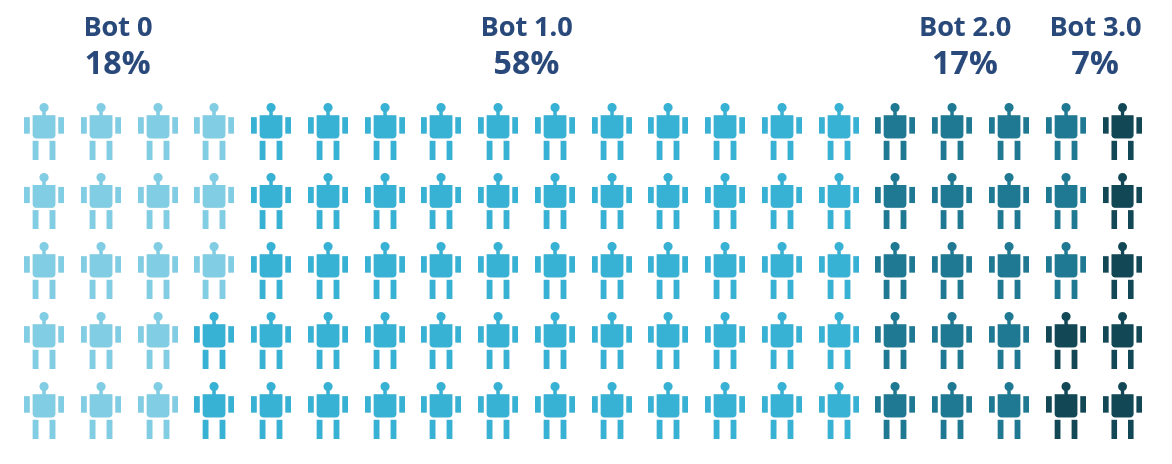

Against this framework, we surveyed over 1,000 companies – but only a third qualified to participate in the study, given our filters. And here’s the distribution of those 321 companies:

Source: ISG Research, 2018

Not surprisingly, the majority of organizations are at Bot 1.0. They’re in production but really just getting started. Only a small percentage of companies we looked at are at Bot 3.0 – meaning, they have RPA deployed to multiple functions, a mature CoE, are live on cognitive, and had the highest scores on our capability statements. It’s important to keep in mind here that what we’re measuring is RPA capability and maturity, not adoption. We’re inferring adoption rates, but at this point, RPA is a “when” not “if” question, so we’re more interested in the underlying mechanisms companies are putting in place to build, support and scale a digital workforce.

One of the most interesting findings so far is how an enterprise’s bot level compares to how it meets or exceeds business expectations – expectations like cost savings, productivity, compliance, accuracy and customer experience. The great news is that the majority of organizations we looked at are meeting their expectations with RPA. But what’s even more interesting is that almost half (46 percent) of Bot 3.0 companies are exceeding their expectations in these areas, as compared to about one-third of Bot 1.0 and 2.0 companies. Given that Bot 3.0 companies have more experience than Bot 1.0 and 2.0 companies, they are also better at accurately estimating business benefits.

But we’re not solely focused on the here and now in this study; we’re also keenly interested in what’s going to happen tomorrow. To measure this, we performed real-time “swarm intelligence” using some award-winning technology from Unanimous AI. And what came through loud and clear in this swarm was 1) the degree to which companies are focusing on productivity as a business goal (rather than role elimination) and 2) how important cognitive technology will be over the next three years to realizing this goal.

For example, here’s a replay (gif) that shows how attendees deliberated when asked how automation ROI will be calculated over the next three years:

Source: ISG Research, 2018

When we asked attendees to respond to another question about whether the market will focus on automating tasks to improve productivity, or focus on automating roles to reduce costs, 75 percent chose the former. This syncs well with what we are seeing in our Bot 3.0 research as well: 72 percent of organizations actively engaged in RPA are focused on automating tasks rather than specific roles and 76 percent of them indicated they can almost always find higher value work for people to do when RPA automates the tasks they previously did manually.

Cognitive automation was also a topic of great interest. Only a few organizations in attendance felt that they are currently at or near a Bot 3.0 level (which means they are live with at least one cognitive use case to extend RPA), but there was consensus that, without cognitive, RPA was going to hit a wall in the near future – due to the volume of unstructured data on the front end and the need for decision-making on the back end, both of which basic RPA is not designed to handle.

The collective “swarm” determined that demand for cognitive systems that help make business decisions will grow rapidly over next year, supporting the idea that the RPA “wall” may be happening more frequently at the end of the process, rather than at the beginning of it.

Source: ISG Research, 2018

Does this mean that near-term cost reduction is no longer an initial goal for enterprises investing in automation? Absolutely not. Our study shows that those enterprises that are new to RPA prioritize near-term cost savings (via headcount reduction) as a priority. But we also are finding that, as companies mature their RPA capability and move towards Bot 3.0, they’re increasingly estimating and realizing the “softer” side of automation benefits – benefits like hours returned to the business, found money and improved competitiveness.

ISG Insights subscribers can look for the full results of our Bot 3.0 study in mid-August.

About the author

Stanton Jones helps clients maximize the value of their emerging technology investments. His current research focuses on the application of Intelligent Automation to enterprise operations, helping clients navigate the fast-moving ecosystem of technology vendors and service providers. Stanton is a recognized expert, and has been quoted in CIO, Forbes and The Times of London.