Rapid technological change, a roaring economy and an increasingly competitive market are forcing today’s enterprises to take on the key business initiative of our time: digital transformation. Yet, internal legacy financial processes – themselves offshoots of older work models – can throw serious obstacles in front of these transformation projects. Whether it’s lining up financial and political support or receiving necessary corporate project approval, sometimes even the best initiatives have a hard time getting off the ground.

The most common issue? Uncertainty in the business case.

Traditional IT financial modeling has been measured largely by its impact on IT operations. The business case asks “what are the hard IT savings that this initiative is driving? What will those costs be replaced by, and when? What is the opportunity cost of not doing the work?” When it comes to rationalizing service providers, outsourcing, procuring or more efficiently operating existing technologies, traditional IT initiatives tend to have a measurable financial impact that clearly point to a go/no-go decision.

Digital transformation initiatives are a different beast. They can have a dramatic impact on organizational finances, but that impact can be difficult to prove upfront and may even be a matter of dispute. As such, digital transformation initiatives require more flexible scenario-based analytical tools that can help quantify value beyond cost reduction – in areas including quality, customer experience and employee engagement – and mobilize organizational support to move forward with the work effectively.

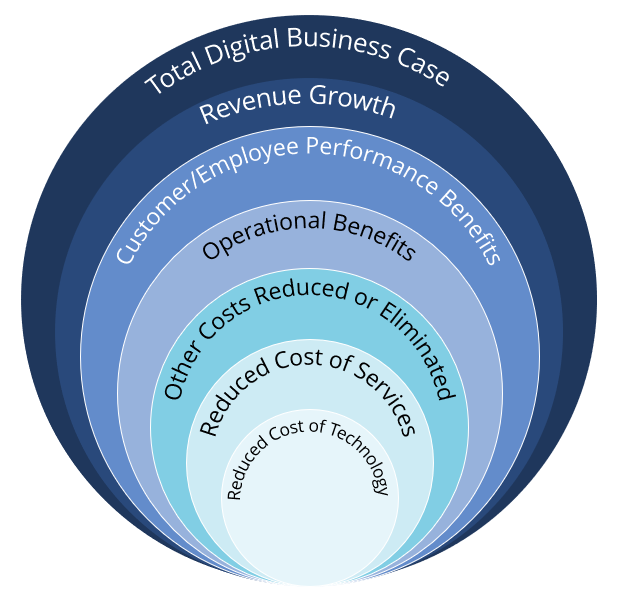

How, specifically, are these projects different? In the illustration below, IT operations predominantly live in the innermost three circles. Yet digital transformation has the potential to drive benefits in the outer circles.

ISG’s digital transformation modeling methodology depicted here illustrates the expanded world of value analysis and helps companies assess the true financial impact of their digital decisions.

- Reduction of working capital: Pairing digital transformation with just-in-time (JIT) and Lean principles allows a company to reduce working capital, drive improved operational efficiency, and free up funds for more strategic, long-term investments. For example, through data analytics, artificial intelligence (AI) and automation, a retail company can significantly reduce its average volume of inventory and manage its orders more precisely to its needs. This in turn facilitates a less wasteful, more efficient environment.

- Cost take-out from operational improvements: Digital capabilities like robotic process automation (RPA), AI, virtual and artificial reality (VR/AR), big data, mobility, and the internet of things (IoT) can enable operational improvements that reduce maintenance costs and limit resource consumption, while avoiding regulatory and legal issues. The use of IoT in a production facility, for example, allows a company to move from a reactive maintenance model to a predictive and preventative model, driving down the cost to maintain and service equipment.

- Revenue enhancements from operational improvements: Investing in digital initiatives that improve operations and increase throughput and quality also can have an impact on a company’s top line. In the example above, more accurate prediction and prevention of downtime doesn’t just limit costs, it avoids revenue leakage arising from that downtime because saleable widgets that could not be made before now can be.

- Top-line growth from improved customer experience: Initiatives that provide digital insights to facilitate better engagement with customers (and partners) can increase customer wallet share and retention and accelerate customer acquisition, which generates increased revenue. For example, a well-executed data and analytics program that provides intelligent customer insights can help a company create an hyper-personalized experience that addresses specific customer needs across channels. Having the “storefront” and customer service at customers’ fingertips drives previously unattainable business.

- Bottom-line growth from improved customer experience: Digital projects that improve the effectiveness of customer channels or eliminate inefficient activities and products in the customer lifecycle can result in significant cost take-out. RPA and AI that eliminate unnecessary tasks in the customer channel are prime examples.

- New revenue streams: Digital transformation enables enterprises to develop new service offerings that create new revenue streams. For example, data and analytics equips companies with insights about customer preferences and sales trends at such a granular level that the data itself stimulates and facilitates the creation of new products, capabilities or services targeted to customer wishes – facilitating an agile and targeted approach to sales generation not possible in the pre-digital age.

Digital transformation does not conform to an apples-to-apples world. Some solutions offer benefits from a faster deployment of certain capabilities, for example, or different scenarios for adoption, scalability and support costs. Many times, suppliers and implementers articulate the benefits of transformation in blue-sky scenarios in which everything goes right and comes in under budget. But decision-making in reality requires better analytical rigor to adequately determine risks, constraints, total deployment costs, contingencies, change management. And an enterprise needs the right tools to do so. One leader might feel, for example, that customer-experience-driven top-line growth would be limited to X, while another might object that the upside is significantly higher. With more sophisticated modeling, users can “dial” to interactively view potential outcomes, and create “on the fly” and “at a glance” reports that facilitate a collaborative “build and agree” process for finding the true potential of an opportunity.

In short, financial modeling of the costs/benefits of digital transformation initiatives requires a holistic approach that can quantify these benefits, measure project value drivers and allow for scenario-driven views, iteration and restatement. A strategic side benefit to this financial approach is that it also drives IT and Operations to better align their goals with those of the business. When IT and Operations and business leaders can apply high-quality financial measures to outcomes that align with transformational business objectives, CIOs can reduce uncertainty around digital investment decisions and better assume accountability for business results.

About the authors

Bill is a sourcing industry leader and active proponent of helping to create professional standards and best practices. His areas of expertise include sourcing strategies, shared services and contract negotiations. Throughout his career he has been responsible for both business development and delivery of strategic advisory services in procurement, vendor management and operational transformation.

Jonathan Leiner is an analyst with ISG’s Sourcing Solutions team.

Mr. Oxman brings a couple of decades’ consulting and corporate experience in business process improvement to ISG’s clients. In the course of his career, Jeff has consulted with executives in diverse industries in ten countries on financial, operational and human resource challenges, as well as served CFOs and COOs in corporate roles. He specializes in developing sophisticated financial models and applying robust analytics to help companies address financial, operational, and human resources challenges.