What is Happening?

Application development and maintenance (ADM) is one of the service lines that has been most frequently associated with offshore outsourcing over the past 25-30 years. The phrase “lift and shift” was coined to denote the ease with which many services providers could engage with an enterprise client and assume responsibility for the majority of the maintenance tasks (those were always viewed as less desirable roles) and some of the development activities. This was traditionally done in a staff augmentation model with a time and material (T&M) pricing arrangement. We find this type of engagement still makes up 70-80 percent of the work for many global multi-nationals, Indian heritage, and Tier-2 IT service providers. But it doesn’t represent how today’s buyers of ADM services operate.

What does represent the way ADM services buyers think? What are their requirements for value from services and providers? The answer to these questions are laid out in the new ISG Insights Index™ (i3™) ADM services report published this week for clients of ISG Insights’ PGI research View. The report identifies and explains six sets of typical client situations and needs and then maps those archetypes against the capabilities of 31 relevant services providers. The result helps to align buy-side value requirements with provider-side capabilities in an objective and easy-to-understand presentation.

Why is it Happening?

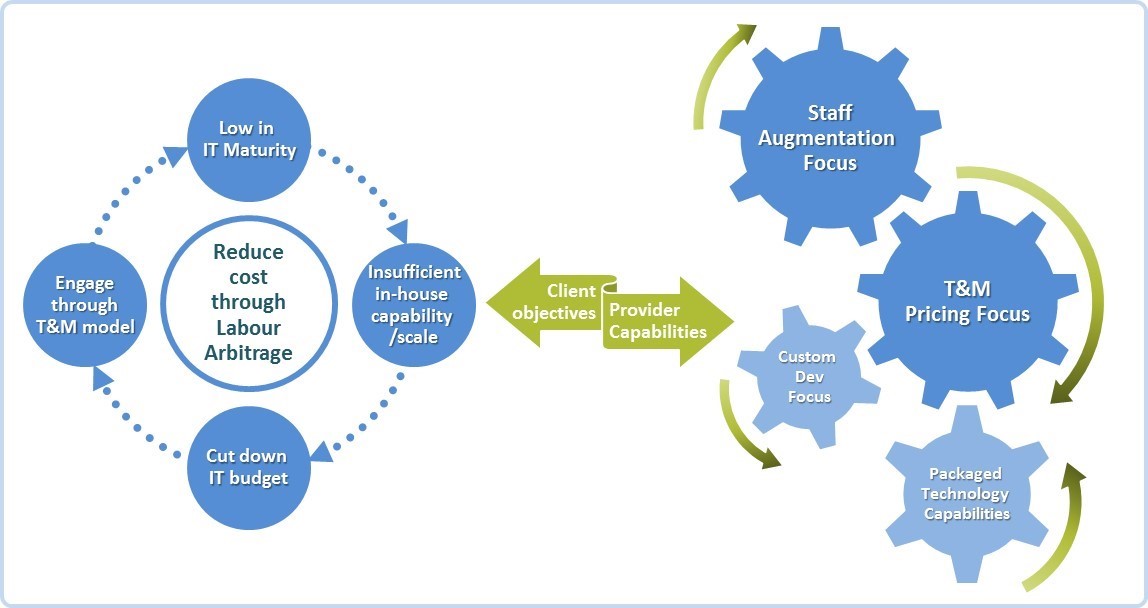

ISG advisors have long recognized the need for a way to match a client’s specific needs—based on their maturity, business objectives and risk tolerance—with services providers’ offerings, capabilities, and experience working with similar clients in similar situations. This new ADM i3 report provides such a capability by mapping client maturity, needs and desires to provider approaches, offerings and expertise (see Figure 1).

Client objectives and situations are organized by “archetypes” that summarize key requirements typical for each point in an enterprise maturity lifecycle. The report identifies six ADM user/client archetypes that represent common circumstances we encounter in our work. The requirements for each archetype are developed from ISG analyst and advisor interaction with large enterprise IT and business organizations, supplemented by our global survey and interview work, as well as our work with and knowledge of services provider offerings, positioning and client case studies.

Mapping Client Objectives vs. Provider Capabilities

Source: ISG Insights 2016

The data regarding provider capabilities comes from similar sources. These include briefings and interviews with providers, survey work, the ISG contract database, and ISG analysts’ and advisors’ experience in developing and managing both buy-side and provider-side services requirements and contracting. These capabilities are then compared to the requirements, weighted and matched to specific archetypes. Finally, for each archetype, a set of services providers whose capabilities are a strong match with the clients’ requirements are identified, listed in alphabetical order and the relative strength of those capabilities are portrayed using a standard “Harvey Ball” indicator model.

The net result is a list of service providers that indicate the closest match to each archetype, based on the known client requirements, as observed by ISG.

Net Impact

In our view, a traditional “ranking” approach, such as those listing the top ten providers by revenue or global reach, does not make provider choices evident or easy. The ADM i3 Report provides an easily-understood visual map of client-side requirements alongside provider strengths, enabling the presentation of the most likely candidates rather than a simplistic ranking. Clients and their advisors thus have a jump start on which services providers they should consider.

This report presents services providers’ known capabilities in the context of user enterprises’ typical project needs (i.e., archetypes). This report is not meant to rank providers or to assert that there is one top provider whose abilities can meet the requirements of all clients that identify with a particular archetype.

ADM is changing at a rapid pace, and not all traditional services providers are willing or able to meet the new requirements laid out by their clients. DevOps, bi-modal, Mode 2 capabilities and agile-centric development environments are not new concepts; they are increasingly the reality in user organizations around the world. Balances must be struck (and often re-balanced multiple times) between optimal business value and relative cost of provider engagement, integration and management. Market changes, new business models and fluctuating economic factors will continually conspire to add to and subtract from buy-side requirements.

Change in buyer types and needs is also giving way to a set of non-traditional service providers. Many niche and Tier-2 and Tier-3 players are factored into this report, along with some of the usual suspects.

The new report is available for immediate download by clients of the ISG Insights Provider Governance, Integration and Operations subscription research view. Clients may log in and download a PDF of the report. Non-clients may obtain copies of the report by contacting ISG Insights.

About the authorJan Erik Aase has more than 30 years of experience as a client. At both American Express and Ameriprise Financial, he lead vendor management offices and managed strategic outsourcing relationships. As an industry analyst at Forrester Research Inc., he conducted and wrote research on the topics of innovation, the future of outsourcing, sourcing models, risk, governance, captive centers, testing and alternative markets. As a service provider at Infosys, he was accountable for helping clients improve the relationship and value they were getting from their outsourcing engagements. At ISG, he has worked as an advisor and consultant assisting clients and service providers implement service integration and management (SIAM) models and the governance processes that support them. Now, as a director and principal analyst with ISG Insights, he continues to research, analyze and write about the industry.