As merger and acquisition activity continues to ramp up, some companies are discovering they are not meeting the short- or long-term value realizations they initially anticipated. The traditional methods of optimizing costs post-M&A are falling short of expected internal rates of return. This has generated internal headwinds that hamper enterprise agility and resilience and increase enterprise exposure to cyber-attacks and other risks.

There’s no question an acquisitive company needs to assimilate its target. But the much-talked-about synergies from a merger should not be the first priority. In fact, successful M&As report integration synergies as the third most important factor. The first priority of an M&A or divestiture should be rigorous cost optimization with the goal of scaling or syncing costs for the NewCo operating model.

Organizations that recognize this can leverage two fundamental and proven principles as part of their M&A integration and assimilation cost plan. One is to take an Agile approach informed by the virtuous cycle economic theory. The other is the application of the zero-based approach.

An Agile Approach to Cost Initiatives

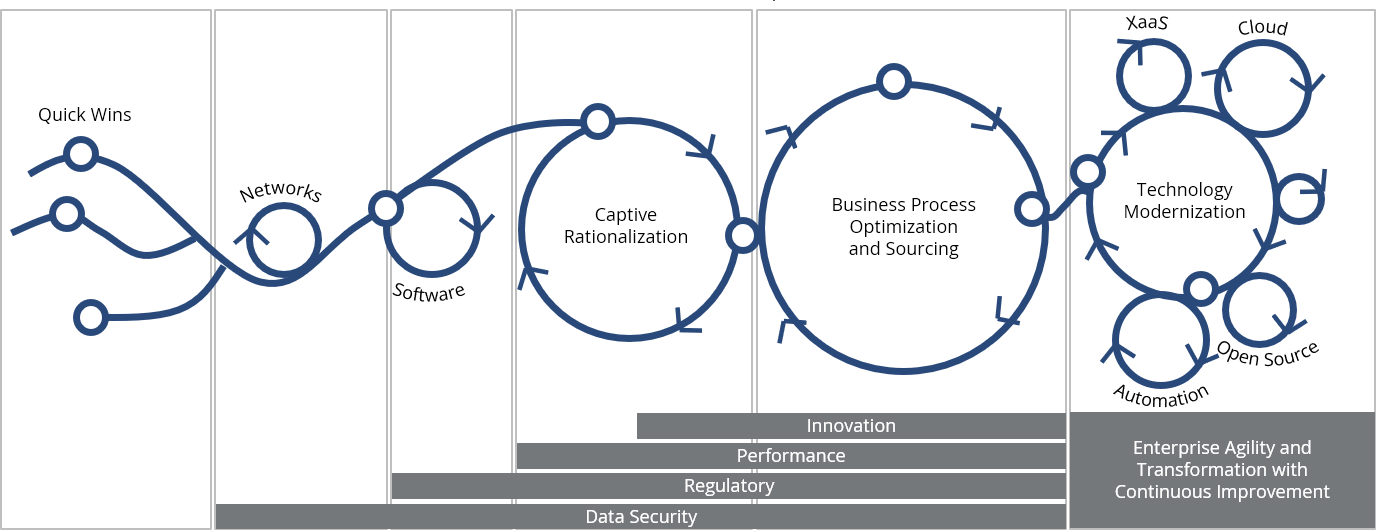

Agile methodology of cost optimization uses sprints to optimize savings in parallel with ongoing and further cost opportunity assessments. The addition of a virtuous cycle approach prevents tactical cost takeout efforts from happening in isolation or other efforts that are disconnected from the broader cost optimization strategy. As is the case with the relationship of revenue to expenditure in virtuous cycle economic theory, so too are initiatives that act as funding mechanisms must be equally balanced with initiatives that are capital intensive. In this way, each cost initiative builds on and/or reinforces another. For example, a short-term network cost takeout initiative would be closely linked to a longer-range technology modernization or ERP integration initiative to mitigate runaway technical debt or a rise in the cost of capital.

Zero-based Methods for Cost Initiatives

Zero based methodologies provide a framework that suits today’s hyper-dynamic digital landscape. By continuously re-baselining and benchmarking relevant performance metrics, you can evaluate underlying costs against both value recognition and market evolution. Because it promotes innovation, creates efficacy at scale, and has the potential to accelerate value realization, it endows global organizations with the type of competitive agility commonly associated with nimbler, growth-oriented enterprises. No longer would business executives be misguided by operational reports and financial models that are based on a standard that no longer represents the target percentile, particularly from the perspective of technology and enterprise maturity.

To drive cost optimization with these principles – and to get the most value out of an M&A – organizations need the right tools. They need to be able to mine applicable business processes and software packages and access germane benchmark data representative of existing the business model. They also need to maintain deep knowledge of both functional domains and the associated industry.

ISG has practical experience coordinating cost optimization strategies as part of M&A activity, and we know how to get powerful results. Contact us to find out how we can help you.

Our unique and continuous approach to cost optimization and value realization ensures that each savings initiative seamlessly reinforces another to optimize savings and facilitate overall enterprise agility.

About the authors

Michael Fullwood is an ISG Partner with extensive financial planning and analysis experience. His areas of expertise include sourcing assessment and RFP management, contract negotiations and transitions. He has guided major multinational companies in the Americas and Europe through multi-functional outsourcing projects and shared services transformation. Michael has more than 20 years of experience advising clients on strategy and implementation and is an accomplished leader who articulates a compelling point of view for ROI optimization and speed to value. His work enables companies to optimize support services operations, contract for and implement digital/automation, and formalize processes, metrics, governance and reporting.

Kevin brings more than 25 years of experience implementing and managing all aspects of global business services. He is a multi-disciplined leader with a proven track record working with cross-functional teams to accomplish targeted business objectives. Kevin has helped organizations in North America, Europe and Brazil create operational efficiency and business transformation through shared services, business process improvement, organizational reengineering and sourcing strategy alternatives. Prior to joining ISG, Kevin held positions with Infosys BPO, Everest Group, Metromedia Restaurant Group, Yum Brands and Price Waterhouse. He is a CPA and Certified Global Management Accountant.